Top Large Cap Fund to invest 2025

What is a large-cap fund

Last year’s large-cap Fund returned 20.50% as of May 14, 2025, Large-cap funds are a type of Equity fund that invests in Highest Market Capitalization 100 companies in India

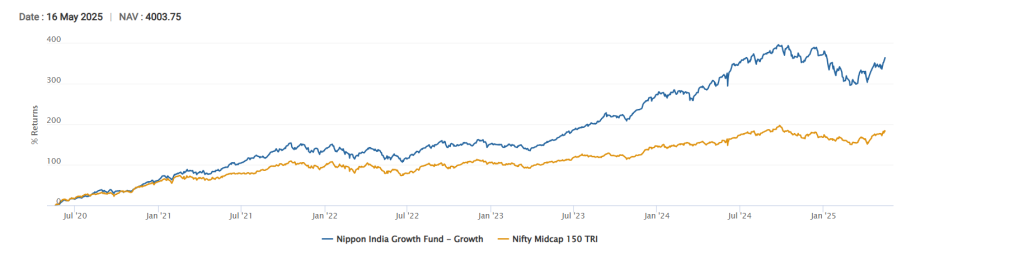

Nippon India Large Cap Fund Gr

Nippon India Large Cap Fund is a prominent equity mutual fund focusing on investing in India’s top 100 companies through market capitalization. More Detailshttp://p.njw.bz/12566 @NJWEALTH @https://www.instagram.com/rrawealth_creation

🚀 Fund Overview

- Benchmark: BSE 100 Tri

- Date of Inception: 08-08-2007

- Expense Ratio: 1.58%

- Options Available: Growth/dividend

- Minimum – SIP 100 & Lum sum :100

- Exit Load: Upto 7 Days 1%

- Category : Equity – Large Cap Fund

- Fund Manager Mr. Sailesh Raj Bhan MBA Finance CFA ICFAI, Exp.: 12 + Years.

- Fund Manager Mr. Bhavik Dave

| YEARS | LUMSUM PERFORMANCE | SIP PERFOMANCE |

| 1 Year | 8.43% | 1.5% |

| 3 Year | 22.9% | 18.44% |

| 5 Year | 28.68% | 21.00% |

| 10 Year | 13.83% | 16.36% |

| Since Inception | 12.99% | 15.04% |

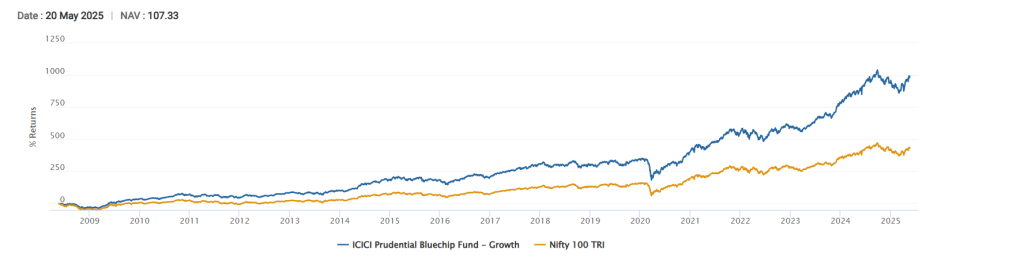

ICICI Prudential Blue chip Fund – Gr

ICICI Prudential Bluechip Fund – Growth is a large-cap equity mutual fund. www.stepup-wealth.com It aims to generate long-term capital appreciation by investing predominantly in equity and equity-related securities of large-cap companies. More Details @ETMONEY http://p.njw.bz/12566

🚀 Fund Overview

- Benchmark: Nifty 100

- Date of Inception: 23-05-2008

- Expense Ratio: 1.47%

- Options Available: Growth/dividend

- Minimum – SIP 100 & Lum sum :100

- Exit Load: 1% Upto 1 Year

- Category : Equity – Large Cap Fund

- Fund Manager Mr. Rajat chandak B. Com, PGDM , Exp.: 2 + Years.

- Fund Manager Mr. Anish tawakley PGDM, B Tech

- Fund Manager Mr. Vaibhav dusad

| YEARS | LUMSUM | SIP |

| 1 Year | 10.21% | 4.92% |

| 3 Year | 20.74% | 18.61% |

| 5 Year | 25.87% | 19.45% |

| 10 Year | 13.94% | 16.11% |

| Since Inception | 15.03% | 15.63% |

More Details http://p.njw.bz/12566

Invesco India Large cap Fund – Growth

Invesco India Large Cap Fund is an open-ended equity mutual fund that primarily invests in large-cap companies—those ranked among the top 100 by market capitalization in India. More Detailshttp://p.njw.bz/12566 @sourceeconomictimes.indiatimes.com

🚀 Fund Overview

- Benchmark: Nifty 100 Tri

- Date of Inception: 21-08-2009

- Expense Ratio: 2.1%

- Options Available: Growth/dividend

- Minimum – SIP 100 & Lum sum :1000

- Exit Load: Nil

- Category : Equity – Large Cap Fund

- Mr. Amit Nigam PGDBM from IIM Indore BE from IIT Roorkee , Exp.: 10 + Years..

- Mr. Hiten Jain

| YEARS | LUMSUM | SIP |

| 1 Years | 9.03% | 1.47% |

| 3 Years | 18.82% | 16.91% |

| 5 Years | 22.79% | 16.87% |

| 10 Years | 12.40% | 14.31% |

| Since Inception | 12.86% | 13.60% |

Click Here http://p.njw.bz/12566

Canara Robeco Bluechip Equity Fund – Gr

Canara Robeco Bluechip Equity Fund Growth is a large-cap equity mutual fund designed to provide long-term capital appreciation by investing predominantly in companies with large market capitalizations. @advisorkhoj

📊 Fund Overview

- Benchmark: Bse 100 Tri

- Date of Inception: 20-08-2010

- Expense Ratio: 1.68%

- Options Available: Growth/dividend

- Minimum – SIP 100 & Lumcsum :15000

- Exit Load: 1% Upto 1 Year

- Category : Equity – Large Cap Fund

- Fund Manager Mr. Shridatta Bhandwaldar

- Fund Manager Mr. Vishal Mishra

| YEARS | LUMSUM | SIP |

| 1 YEARS | 11.76% | 4.64% |

| 3 YEARS | 17.90% | 16.18% |

| 5 YEARS | 22.09% | 16.02% |

| 10 YEARS | 13.42% | 15.22% |

| Since Inception | 13.15% | 14.44% |

Click Here http://p.njw.bz/12566

Baroda BNP Paribas Large Cap Fund – Gr

Baroda BNP Paribas Large Cap Fund Growth stands out as a reliable option for investors seeking long-term capital appreciation through investments in established large-cap companies.@ETMONEY

📊 Fund Overview

- Benchmark: Nifty 100 Tri

- Date of Inception: 21-08-2009

- Expense Ratio: 2.10%

- Options Available: Growth/dividend

- Minimum – SIP 100 & Lum sum :1000

- Exit Load: Nil

- Category : Equity – Large Cap Fund

- Fund Manager Mr. Amit Nigam PGDBM from IIM Indore BE from IIT Roorkee,

- Fund Manager Mr. Hiten Jain

| YEARS | LUMSUM | SIP |

| 1 Years | 4.96% | -2.36% |

| 3 Years | 18.58% | 15.79% |

| 5 Years | 22.14% | 16.43% |

| 10 Years | 12.34% | 14.49% |

| Since Inception | 16.02% | 13.87% |

Click Here http://p.njw.bz/12566

Note: Past performance is not indicative of future results. Investors should consult their financial advisors before making investment decisions.

Mutual fund investments are subject to market risks. Read all scheme-related documents carefully

Pingback: What is a SYSTEMATIC INVESTMENT PLAN? - STEP UP WEALTH

Pingback: SIP नहीं SWP है बेस्ट! एक बार निवेश और हर महीने मुनाफा - STEP UP WEALTH

https://shorturl.fm/y6S0b

https://shorturl.fm/wS1vf

https://shorturl.fm/SeIHQ

https://shorturl.fm/ptQzU

https://shorturl.fm/q90IG

https://shorturl.fm/TybYo

https://shorturl.fm/QUgFg

https://shorturl.fm/36MRR

https://shorturl.fm/hPpDh

https://shorturl.fm/56TIQ

https://shorturl.fm/doFU5

https://shorturl.fm/tbPRH

https://shorturl.fm/a8bdY

https://shorturl.fm/1KiOk

https://shorturl.fm/91aKU

https://shorturl.fm/fpC7W

https://shorturl.fm/mMIxk

https://shorturl.fm/bIdYN

https://shorturl.fm/Z2LHq

https://shorturl.fm/8eBOr

https://shorturl.fm/MqAeg

https://shorturl.fm/ntd7Q

https://shorturl.fm/JrnfP

https://shorturl.fm/zxbKk

https://shorturl.fm/CFVGd

https://shorturl.fm/8KrqS

https://shorturl.fm/1XeRa

https://shorturl.fm/c4Zf7

https://shorturl.fm/ZamvM

https://shorturl.fm/sWOK1

https://shorturl.fm/STd2b

https://shorturl.fm/Vmocz

https://shorturl.fm/g97Zx

rsyzqdvgkinxnkmvkmjemqvkzvejdm

https://shorturl.fm/RT7jC

https://shorturl.fm/i4EyV

lzomnffeftlhidvgnskjfsolhpyqqh

https://shorturl.fm/saDHq

https://shorturl.fm/1C3Zs

https://shorturl.fm/73TbO

https://shorturl.fm/FMSBD

https://shorturl.fm/NlfaH

https://shorturl.fm/qGqPr

https://shorturl.fm/DPI1O

https://shorturl.fm/deNfJ

https://shorturl.fm/GO0J2

https://shorturl.fm/lAgdg

https://shorturl.fm/v5P8w

https://shorturl.fm/2QZLT

https://shorturl.fm/vexSQ

https://shorturl.fm/D3Djk

Get paid for every click—join our affiliate network now!

Join our affiliate program today and start earning up to 30% commission—sign up now!

Refer friends, collect commissions—sign up now!

Earn recurring commissions with each referral—enroll today!

Sign up for our affiliate program and watch your earnings grow!