Spread the love

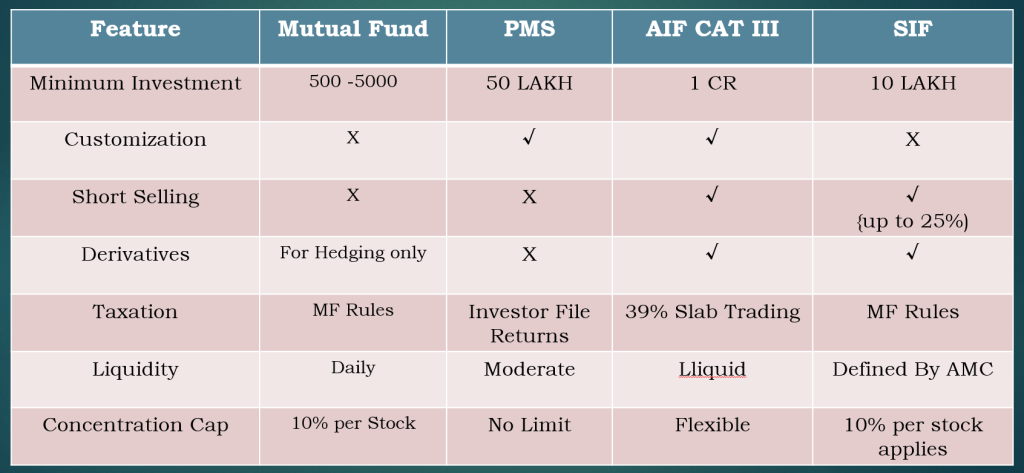

SEBI has launched a new category of mutual funds. SIF (Specialized Investment Fund) starting 1st April 2025, designed for Wealthy, Sophisticated Investors who want to go beyond the traditional mutual fund universe. Think of it as the Premium version Of The Mutual Fund, Offering Access to Complex Strategies Like Derivatives, Short Selling, Structured Products, And More, But With a Mutual fund-like taxation and Regulatory Structure.Minimum Investment Requirement

- Minimum Investment: 10 LAKH per PAN card

- Can be Split Across Multiple SIF Schemes

- You Can Invest 3 Lakh in one SIF, 4 LAKH in another, and 3 LAKH Elsewhere, but the total must remain 10 Lakh

- SIPs allowed, but the cumulative total must maintain the 10 lakh threshold.

Regulatory Safeguards by SEBI

- Only AMC With:

- 10000 Cr AUM ( + 3 years ) OR

- CIO With 5000 Cr AUM + 10 Years Expernence

- Risk-o-Meter System

- 5 Levels – Low to Very High

- Updated monthly &disclosed on AMC + AMFI Website

Liquidity Rules – How SIFs Differ from Mutual Funds

- No Daily Redemption

- This ensures liquidity control for high-risk portfolios.

- AMC { FUND HOUSE } can define withdrawal frequency:

✨ Unique Features of SIFs

Use of Derivatives & Leverage

- SIFs can use unhedged derivatives up to 25% of the corpus.

- Naked short selling allowed – speculate without owning the stock.

- Options limit – 20% corpus { one premium, not notional value}

- For Example 20 CR Premium may have 100 CR exposure, with potential 2x leverage

Taxation of SIFs

| Portfolio Type | Tax type |

| Equity >65% | 15% STCG, 10% LTCG |

| Equity 35% – 65% | Slab STCG, 20% with indexation (LTCG 2 years) |

| Debt >65% | Slab Rate |

Tax-efficient alternative to Category III AIFs, which attract up to 39% tax on trading income.

Debt-Oriented Strategies

Debt Long-short:

- Across maturities with interest rate derivatives

- 25% short position via debt derivatives

Sectoral Debt Long Short:

- Exposure to 2+ sectors

- max 75 % in any one sector

Hybrid Strategies

Active Asset Allocator:

- Dynamic allocation across equity, debt, REITs, and Commodities

- max 25% unhedged derivatives

Hybrid Long Short:

- min 25% in equity + 25% in debt

- max 25%short allowed

SIFs VS Traditional Products- Where it Fit?

- Ideal for those seeking.

- Tax-efficient long-short strategies.

- Partial AIF benefits without a 1 CR Ticket size

- Greater Portfolio Diversification & control

- Not a replacement for PMS, as PMS allows higher concentration and tailored portfolios

- https://www.instagram.com/p/DKq_02lRQ4P/?img_index=1

https://shorturl.fm/xH38L

https://shorturl.fm/fXFCg

https://shorturl.fm/V9Lvd

https://shorturl.fm/wEigv

https://shorturl.fm/HyCV2

https://shorturl.fm/5ioNP

https://shorturl.fm/0auuq

https://shorturl.fm/Z7Rev

https://shorturl.fm/Nh2x6

https://shorturl.fm/cvMxb

https://shorturl.fm/cwbOz

https://shorturl.fm/wUqGW

https://shorturl.fm/q90IG

https://shorturl.fm/hSKz5

https://shorturl.fm/CrZOn

https://shorturl.fm/Aa71g

https://shorturl.fm/f3igS

https://shorturl.fm/JPtQR

https://shorturl.fm/2I04N

https://shorturl.fm/qxs8O

https://shorturl.fm/q81Mm

https://shorturl.fm/36MRR

https://shorturl.fm/95PEo

https://shorturl.fm/SLNIS

https://shorturl.fm/PjLdU

https://shorturl.fm/rZAWf

https://shorturl.fm/Dkit6

https://shorturl.fm/Xc10J

https://shorturl.fm/5z524

https://shorturl.fm/bmQsz

https://shorturl.fm/Awzg1

https://shorturl.fm/GztFW

https://shorturl.fm/utOaR

https://shorturl.fm/XwCl1

https://shorturl.fm/uZjnR

https://shorturl.fm/rqjci

https://shorturl.fm/4Csrl

https://shorturl.fm/4Csrl

https://shorturl.fm/MmiZ9

https://shorturl.fm/q192E

https://shorturl.fm/fYsmg

https://shorturl.fm/A9sux

https://shorturl.fm/BdQxv

https://shorturl.fm/vX47a

https://shorturl.fm/xg4x3

https://shorturl.fm/5DaJ0

https://shorturl.fm/kyrV2

https://shorturl.fm/SCoaU

https://shorturl.fm/0eLYu

https://shorturl.fm/zJ8CW

https://shorturl.fm/tbPRH

https://shorturl.fm/Q5V0I

https://shorturl.fm/PHCqt

https://shorturl.fm/6yAtj

https://shorturl.fm/q20zb

https://shorturl.fm/oQVC6

https://shorturl.fm/HNl93

https://shorturl.fm/rpo3I

https://shorturl.fm/xMrTD

https://shorturl.fm/q23OW

https://shorturl.fm/Eff57

https://shorturl.fm/SZoHc

https://shorturl.fm/81NAl

https://shorturl.fm/E2cJR

https://shorturl.fm/36oeJ

https://shorturl.fm/Brkt1

https://shorturl.fm/VcS5m

https://shorturl.fm/kT2ZT

https://shorturl.fm/JTYfq

https://shorturl.fm/gkhSZ

https://shorturl.fm/zIqzP

https://shorturl.fm/oYWUa

https://shorturl.fm/eKMy5

https://shorturl.fm/LXJF8

https://shorturl.fm/NHivt

https://shorturl.fm/rS0yN

https://shorturl.fm/x7xVU

https://shorturl.fm/NJY8v

https://shorturl.fm/rZyFu

https://shorturl.fm/Nxa4U

https://shorturl.fm/C4lTy

https://shorturl.fm/LJGFa

https://shorturl.fm/kgDdM

https://shorturl.fm/e30S0

https://shorturl.fm/0vh44

https://shorturl.fm/p5Pfm

https://shorturl.fm/siugt

https://shorturl.fm/jF5m1

https://shorturl.fm/c9FGS

https://shorturl.fm/B0dv4

https://shorturl.fm/uwjmk

https://shorturl.fm/jWtJY

https://shorturl.fm/Beor8

https://shorturl.fm/GcQXo

https://shorturl.fm/jOBgC

https://shorturl.fm/ptAnw

https://shorturl.fm/aE42O

https://shorturl.fm/J8tzz

https://shorturl.fm/d2Zzu

https://shorturl.fm/vIjve

https://shorturl.fm/OeVfU

https://shorturl.fm/dJ78X

https://shorturl.fm/uyIKV

https://shorturl.fm/PabqU

https://shorturl.fm/UbePL

https://shorturl.fm/baWnq

https://shorturl.fm/BwKW0

https://shorturl.fm/WTtOs

https://shorturl.fm/fbZ6r

https://shorturl.fm/mDhLk

https://shorturl.fm/ZxyWg

https://shorturl.fm/FTBkR

https://shorturl.fm/l7DJG

https://shorturl.fm/aBABt

https://shorturl.fm/As8j4

https://shorturl.fm/DqDnX

https://shorturl.fm/BhIZL

https://shorturl.fm/SzgQF

https://shorturl.fm/aiRTk

https://shorturl.fm/T7WuE

https://shorturl.fm/C21rh

https://shorturl.fm/mxO5N

https://shorturl.fm/8F5Wf

https://shorturl.fm/Avc2H

https://shorturl.fm/KKSBZ

https://shorturl.fm/W5oap

https://shorturl.fm/P5Pmp

https://shorturl.fm/Bxziy

https://shorturl.fm/yCddk

https://shorturl.fm/e0301

https://shorturl.fm/7XAxo

https://shorturl.fm/nNMFh

https://shorturl.fm/wd6dj

https://shorturl.fm/wVDzV

https://shorturl.fm/Tgcrk

https://shorturl.fm/ZGxls

https://shorturl.fm/Bf3KS

https://shorturl.fm/V0aSn

https://shorturl.fm/NGLYz

https://shorturl.fm/50ye3

https://shorturl.fm/pTcJP

https://shorturl.fm/K6r2S

https://shorturl.fm/8xD70

https://shorturl.fm/KHS1q

https://shorturl.fm/szEsk

https://shorturl.fm/AYCOE

https://shorturl.fm/AYCOE

https://shorturl.fm/uAQtC

https://shorturl.fm/0sBLg

https://shorturl.fm/joJLG

https://shorturl.fm/qXlqM

https://shorturl.fm/4MkXa

https://shorturl.fm/7tarB

https://shorturl.fm/HESoO

https://shorturl.fm/bJc74

https://shorturl.fm/rXVoT

https://shorturl.fm/EBtCG

https://shorturl.fm/EBtCG

There is an artistry in the structure here. Sentences build upon one another with care, creating a tapestry where every thread matters to the whole.

https://shorturl.fm/PBQQj

https://shorturl.fm/lDhCx

https://shorturl.fm/C1uf9

https://shorturl.fm/xQgwh

https://shorturl.fm/1qyJc

https://shorturl.fm/gXNpH

https://shorturl.fm/Hv0sH

https://shorturl.fm/Hv0sH

https://shorturl.fm/elnuD

https://shorturl.fm/PAYzY

https://shorturl.fm/yHMQs

https://shorturl.fm/kjTpC

https://shorturl.fm/I6F5f

https://shorturl.fm/FpHvW

https://shorturl.fm/3nLoI

https://shorturl.fm/oUC6m

https://shorturl.fm/GjxEB

https://shorturl.fm/Cjelr

https://shorturl.fm/Uyzk2

https://shorturl.fm/7vDS7

https://shorturl.fm/fQR1W

https://shorturl.fm/AguKo

https://shorturl.fm/mgfU5

https://shorturl.fm/k73ml

https://shorturl.fm/pcMWs

https://shorturl.fm/PJV41

https://shorturl.fm/JFqMR

https://shorturl.fm/SggP9

https://shorturl.fm/4MArH

https://shorturl.fm/auxiJ

https://shorturl.fm/2yTRJ

https://shorturl.fm/L9hhx

https://shorturl.fm/Niqgh

https://shorturl.fm/bdBYN

https://shorturl.fm/fr7n4

https://shorturl.fm/4UNnF

https://shorturl.fm/mimgi

https://shorturl.fm/6WE4m

https://shorturl.fm/5fUvm

https://shorturl.fm/edrqB

https://shorturl.fm/Jnlpi

https://shorturl.fm/VAEzH

https://shorturl.fm/qmxU5

https://shorturl.fm/MnQH8

https://shorturl.fm/yWr1I

https://shorturl.fm/3axWp

https://shorturl.fm/Aq7Ii

https://shorturl.fm/ckI1q

https://shorturl.fm/91USm

https://shorturl.fm/mShdl

https://shorturl.fm/jbyu3

https://shorturl.fm/ptE9H

https://shorturl.fm/rPlNh

https://shorturl.fm/LjBci

https://shorturl.fm/fEmTE

https://shorturl.fm/QmbcY

https://shorturl.fm/3JRHN

https://shorturl.fm/I8LiN

https://shorturl.fm/kz7xz

https://shorturl.fm/TJkVZ

https://shorturl.fm/2oFDN

https://shorturl.fm/6YCXN

https://shorturl.fm/KHLll

https://shorturl.fm/UTBko

https://shorturl.fm/mISNk

https://shorturl.fm/5MthT

https://shorturl.fm/nE80q

https://shorturl.fm/jzAUP

https://shorturl.fm/F6vE2

https://shorturl.fm/dFayj

https://shorturl.fm/h6nts

https://shorturl.fm/o3xCB

https://shorturl.fm/uShMa

https://shorturl.fm/sPJkE

https://shorturl.fm/AMBMC

https://shorturl.fm/zXJYM

https://shorturl.fm/Q9wkn

https://shorturl.fm/hZetK

https://shorturl.fm/pqsYb

https://shorturl.fm/pqsYb

https://shorturl.fm/S9n5o

https://shorturl.fm/u9iGS

https://shorturl.fm/ZGFYe

https://shorturl.fm/eyFBu

https://shorturl.fm/PxBD6

https://shorturl.fm/X7UQW

https://shorturl.fm/KUIWn

https://shorturl.fm/jKd0W

https://shorturl.fm/oE8oh

https://shorturl.fm/yqUh5

https://shorturl.fm/rMVb0

https://shorturl.fm/VAoQg

https://shorturl.fm/fZYKe

https://shorturl.fm/iHPaV

https://shorturl.fm/EgWbz

https://shorturl.fm/AvSlQ

https://shorturl.fm/fzrt6

https://shorturl.fm/i9Luh

https://shorturl.fm/JyxDH

https://shorturl.fm/0psp8

https://shorturl.fm/E0gio

https://shorturl.fm/OoqNH

https://shorturl.fm/Cnmzn

https://shorturl.fm/lWHox

https://shorturl.fm/IWowe

https://shorturl.fm/bbe3i

https://shorturl.fm/geO9x

https://shorturl.fm/9Y2En

https://shorturl.fm/mDuVa

https://shorturl.fm/OaWAD

https://shorturl.fm/HCYL7

https://shorturl.fm/vDtAU

https://shorturl.fm/KTKyj

https://shorturl.fm/CbTNz

https://shorturl.fm/nxrgB

https://shorturl.fm/6jCEU

https://shorturl.fm/3EYz0

https://shorturl.fm/oU7tp

https://shorturl.fm/q16ce

https://shorturl.fm/u2H89

https://shorturl.fm/SLJFz

https://shorturl.fm/Bde6b

https://shorturl.fm/B0hqi

https://shorturl.fm/CkRn4

https://shorturl.fm/d1FKL

https://shorturl.fm/aQ1Zd

https://shorturl.fm/uS0VO

https://shorturl.fm/okmBB

https://shorturl.fm/gOOyl

https://shorturl.fm/NEIha

https://shorturl.fm/pQp52

https://shorturl.fm/YfwtM

https://shorturl.fm/AlJJa

https://shorturl.fm/OzojO

https://shorturl.fm/kKuYP

https://shorturl.fm/lyH4h

https://shorturl.fm/RBosK

https://shorturl.fm/aEog8

https://shorturl.fm/llWzE

https://shorturl.fm/Cj4Ws

https://shorturl.fm/D8zJZ

https://shorturl.fm/F9Moz

https://shorturl.fm/j6rOr

https://shorturl.fm/Cf2Qy

https://shorturl.fm/u76Hz

https://shorturl.fm/Vu0Sd

https://shorturl.fm/Qs7et

https://shorturl.fm/4fh8k

https://shorturl.fm/lOjge

https://shorturl.fm/l6ncY

https://shorturl.fm/rWOFL

https://shorturl.fm/e1Pas

https://shorturl.fm/iRaTX

https://shorturl.fm/GTndE

https://shorturl.fm/fICFm

https://shorturl.fm/RHMzZ

https://shorturl.fm/l7bQr

https://shorturl.fm/nLFsH

https://shorturl.fm/rWODY

https://shorturl.fm/7NXOk

https://shorturl.fm/dcIr3

https://shorturl.fm/mDeU6

https://shorturl.fm/gbvmr

https://shorturl.fm/v0Cjp

https://shorturl.fm/8bReI

https://shorturl.fm/J5KuT

https://shorturl.fm/PA8iX

https://shorturl.fm/7Oyrd

https://shorturl.fm/CF6uO

https://shorturl.fm/jn77Y

https://shorturl.fm/s3Oi3

https://shorturl.fm/UGurT

https://shorturl.fm/tCyq5

https://shorturl.fm/lYfIk

https://shorturl.fm/mX0ZV

https://shorturl.fm/y9tF2

https://shorturl.fm/X4Xlg

uwmwmzpdwsmkvvysqowgnpxhdwkmrg

https://shorturl.fm/5JH3t

https://shorturl.fm/p7ZmY

https://shorturl.fm/TBiET

https://shorturl.fm/uXVhA

https://shorturl.fm/rxIkg

https://shorturl.fm/6GTGf

https://shorturl.fm/Xxy6L

https://shorturl.fm/UO5Sc

https://shorturl.fm/j2fq2

https://shorturl.fm/IZr1g

https://shorturl.fm/PcooI

https://shorturl.fm/PV4LZ

https://shorturl.fm/axl4E

https://shorturl.fm/qszaB

https://shorturl.fm/Mw52e

https://shorturl.fm/q3dNb

https://shorturl.fm/qpD3H

https://shorturl.fm/yr9Fz

https://shorturl.fm/sqrXd

https://shorturl.fm/T8qLV

https://shorturl.fm/09NNS

https://shorturl.fm/txgWs

https://shorturl.fm/mjpis

https://shorturl.fm/0HxIP

https://shorturl.fm/KGfzC

https://shorturl.fm/B8GBn

https://shorturl.fm/LrPTO

https://shorturl.fm/dNbC2

https://shorturl.fm/TWeLf

https://shorturl.fm/c3pfK

https://shorturl.fm/f3KLJ

https://shorturl.fm/qzGdS

https://shorturl.fm/36fzS

https://shorturl.fm/mQ21n

https://shorturl.fm/AFOWD

https://shorturl.fm/7Bw2h

https://shorturl.fm/xzC6n

https://shorturl.fm/xWb8h

https://shorturl.fm/puj7W

https://shorturl.fm/Vhq3K

https://shorturl.fm/4l3s8

https://shorturl.fm/NDLlJ

https://shorturl.fm/AGX1I

https://shorturl.fm/ZBkId

https://shorturl.fm/VXLiJ

https://shorturl.fm/uiF5b

https://shorturl.fm/9uAmK

https://shorturl.fm/3V3vR

https://shorturl.fm/NkbRh

https://shorturl.fm/u2VZr

https://shorturl.fm/5k7ML

https://shorturl.fm/cE7Uz

https://shorturl.fm/DPfgS

https://shorturl.fm/MsfpN

https://shorturl.fm/YDSsm

https://shorturl.fm/XS0so

https://shorturl.fm/GXFY7

https://shorturl.fm/q7kE4

https://shorturl.fm/BLMyq

fewwushphpqxpxhsekqwdqtyoovtke

https://shorturl.fm/BrOLE

https://shorturl.fm/chdMj

https://shorturl.fm/GFQIM

https://shorturl.fm/WA0zA

https://shorturl.fm/r72qo

https://shorturl.fm/saFME

https://shorturl.fm/fFb7q

https://shorturl.fm/IxiBT

https://shorturl.fm/DHftm

https://shorturl.fm/xgdcj

https://shorturl.fm/PwXmq

https://shorturl.fm/p4Bcg

https://shorturl.fm/egzTw

https://shorturl.fm/5aPpK

https://shorturl.fm/O8e7c

https://shorturl.fm/EdFob

https://shorturl.fm/1xN64

https://shorturl.fm/9S0mh

https://shorturl.fm/EDR65

https://shorturl.fm/1DfEg

https://shorturl.fm/yfEKl

https://shorturl.fm/JVlzT

https://shorturl.fm/YTvAN

https://shorturl.fm/JIyxL

https://shorturl.fm/I0nhv

https://shorturl.fm/G65QT

https://shorturl.fm/gIgjy

https://shorturl.fm/77UsN

https://shorturl.fm/BSHax

https://shorturl.fm/QgknX

https://shorturl.fm/dkC8j

https://shorturl.fm/IroZi

https://shorturl.fm/V9HoT

https://shorturl.fm/3U5WE

https://shorturl.fm/go1wn

https://shorturl.fm/w0FQL

https://shorturl.fm/u3drf

https://shorturl.fm/htE9g

https://shorturl.fm/PKlpw

https://shorturl.fm/YZAUP

https://shorturl.fm/lmfRu

https://shorturl.fm/zpSSy

https://shorturl.fm/jo3ma

https://shorturl.fm/s6lDo

https://shorturl.fm/bYL4y

https://shorturl.fm/nXHVq

https://shorturl.fm/Tfkhm

https://shorturl.fm/1yPlU

https://shorturl.fm/ZvVvn

https://shorturl.fm/d65p4

https://shorturl.fm/veIdR

https://shorturl.fm/1Buen

https://shorturl.fm/ywEZ8

https://shorturl.fm/amjnt

https://shorturl.fm/7bpPV

https://shorturl.fm/ZJjZF

https://shorturl.fm/b4VSL

https://shorturl.fm/IzJqH

https://shorturl.fm/vWpp5

https://shorturl.fm/bHbN4

https://shorturl.fm/YXsd7

https://shorturl.fm/sm9gH

https://shorturl.fm/Z20LZ

https://shorturl.fm/aHJTT

https://shorturl.fm/4laRO

https://shorturl.fm/F6Aed

https://shorturl.fm/0TrHX

https://shorturl.fm/n5dLP

https://shorturl.fm/szRWi

https://shorturl.fm/d1BEY

https://shorturl.fm/G3F1N

https://shorturl.fm/lEXhS

https://shorturl.fm/2AzAM

https://shorturl.fm/eWlmv

https://shorturl.fm/Ikrjc

https://shorturl.fm/v7O5O

https://shorturl.fm/vhUg0

https://shorturl.fm/lhWOe

https://shorturl.fm/MxpKM

leoulplgxlfjeipiylefntlzopojue

https://shorturl.fm/tFBNq

https://shorturl.fm/pPFF3

https://shorturl.fm/qWWbT

https://shorturl.fm/F7NQj

https://shorturl.fm/vexSQ

https://shorturl.fm/m4keB

https://shorturl.fm/qXuaV

https://shorturl.fm/rJ7El

https://shorturl.fm/uEXgE

https://shorturl.fm/mA1nL

https://shorturl.fm/o5Jdt

https://shorturl.fm/wovxQ

https://shorturl.fm/LckSK

https://shorturl.fm/g3R70

https://shorturl.fm/iO2iV

Earn your airdrop on Aster https://is.gd/ZceEI6

Fast indexing of website pages and backlinks on Google https://is.gd/r7kPlC

Fast indexing of website pages and backlinks on Google https://is.gd/r7kPlC

Become our affiliate—tap into unlimited earning potential!

Hello https://is.gd/tvHMGJ

Refer and earn up to 50% commission—join now!

Join forces with us and profit from every click!

Monetize your audience—become an affiliate partner now!

Sign up for our affiliate program and watch your earnings grow!

Monetize your audience—become an affiliate partner now!

Partner with us for high-paying affiliate deals—join now!

Monetize your audience with our high-converting offers—apply today!

Unlock top-tier commissions—become our affiliate partner now!

Refer friends and colleagues—get paid for every signup!

Drive sales and watch your affiliate earnings soar!

Start sharing our link and start earning today!

Apply now and unlock exclusive affiliate rewards!

Share your unique link and earn up to 40% commission!

Partner with us and enjoy high payouts—apply now!

Become our affiliate—tap into unlimited earning potential!

Maximize your income with our high-converting offers—join as an affiliate!

Turn your audience into earnings—become an affiliate partner today!

Monetize your traffic instantly—enroll in our affiliate network!

Turn your traffic into cash—join our affiliate program!

Share our products, earn up to 40% per sale—apply today!

Become our partner and turn clicks into cash—join the affiliate program today!

Apply now and unlock exclusive affiliate rewards!

Earn passive income this month—become an affiliate partner and get paid!

Your audience, your profits—become an affiliate today!

Partner with us and enjoy high payouts—apply now!

Promote, refer, earn—join our affiliate program now!

Earn passive income this month—become an affiliate partner and get paid!

Your audience, your profits—become an affiliate today!

Get paid for every click—join our affiliate network now!

Unlock exclusive rewards with every referral—apply to our affiliate program now!

Earn big by sharing our offers—become an affiliate today!

Apply now and unlock exclusive affiliate rewards!

Start sharing, start earning—become our affiliate today!

Share our products, reap the rewards—apply to our affiliate program!

Your audience, your profits—become an affiliate today!

Maximize your earnings with top-tier offers—apply now!

Start profiting from your network—sign up today!